Google Buyouts in USA: Strategic Voluntary Exit Program Amid AI Spending Surge

📌 What’s the Buzz About Google Buyouts in the U.S.?

Google Buyouts in USA : In early June 2025, Google announced a new round of voluntary buyouts—officially dubbed its “Voluntary Exit Program” (VEP)—offered to U.S.-based employees working in key divisions like Search, Ads, Research, Core Engineering, Marketing, and Communications (theverge.com). This move marks another critical step in Google’s strategy to fine-tune its workforce and reallocate resources toward AI-driven initiatives, including the development of Gemini and the expansion of its search engine’s AI Mode (wsj.com).

Unlike hard layoffs, these are voluntary exits that offer at least 14 weeks of severance, with an enrollment deadline of July 1 (theverge.com). The company stresses this is about alignment and engagement, not cutting staff, although workers not fully aligned or motivated are encouraged to consider the offer (theverge.com).

Why Now? The Connect Between Buyouts & AI

1. Funding the AI Revolution

Google is ramping up capital expenditures to about $75 billion in 2025, up from $52.5 billion in 2024 (wsj.com). This massive increase is designed to:

- Supercharge Gemini, Google’s flagship AI model

- Roll out and enhance the AI Mode in Google Search

- Scale up data center and cloud infrastructure

By offering buyouts, Google reallocates human capital savings to fuel this AI transformation (wsj.com, apnews.com).

2. Optimizing Workforce Focus

Google’s strategy appears to be sharpening: retain top talent fully aligned with its AI-first mission and allow others an efficient exit path. According to exec Nick Fox, this program is for those not “aligned with our strategy” or “energized by their work”, while urging high performers to stay (theverge.com).

The Hybrid Work Mandate & Buyouts: A One-Two Punch

Parallel to offering voluntary buyouts, Google is enforcing a stricter Return-to-Office (RTO) policy. Employees in affected U.S. teams who live within 50 miles of an office must adopt a 3-day in-office hybrid schedule, or face potential layoff (theverge.com).

Business Insider reports this RTO mandate is specifically targeting Core Systems, Marketing, Research, Knowledge & Information (Search, Ads, Commerce), and Communications teams in the U.S. (businessinsider.com).

Google frames it as essential for “connection, collaboration, and innovation”—echoing past statements that working together in person fuels faster decision-making and creativity (theverge.com).

What Workers Gain & Lose

✅ Benefits of the Buyout Program

- Severance: At least 14 weeks’ pay, possibly more with tenure-based enhancements (theverge.com).

- Dignified Exit: Employees can leave on their own terms; company touts it as a supportive path (ainvest.com).

- Clear Expectations: Knowing in advance allows affected staff to plan career transitions.

⚠️ Potential Drawbacks

- Exiting means giving up future stock options, bonuses, and benefits tied to Google.

- Accepting the buyout might close doors for internal moves or future re-employment.

- Some employees may feel pressured or uncertain about remaining.

Industry & Market Ramifications

1. Workforce Reset in Tech

Since the wave of layoffs in 2023 (~12,000 jobs) and further layoffs in 2024, this voluntary exit wave demonstrates how Google—and other big tech—are refining the shift toward a leaner, AI-focused workforce model (ainvest.com, businessinsider.com, wsj.com, timesofindia.indiatimes.com).

2. Competitive Positioning in AI

By funding AI with headcount reductions, Google continues to assert leadership against rivals like OpenAI, Microsoft, and other emergent players (linkedin.com).

3. Antitrust & Regulatory Context

This move comes amid continued U.S. antitrust pressure—from search monopolization rulings to ad-tech legal restrictions (en.wikipedia.org). Restructuring may signal investor-wide attempts to demonstrate cost discipline in high-stakes environments.

Related Developments in Google’s Expansion Strategy

Acquisition of Wiz – A $32 Billion Bet

In March 2025, Google announced a record-breaking $32 billion acquisition of Wiz, a cloud-security startup, marking its largest-ever deal and underscoring the emphasis on securing AI and cloud workloads (apnews.com).

This merges with buyout savings to fund both 🚀eth growth and wall-to-wall enterprise security capabilities.

AI Hub Launch in Saudi Arabia

Late 2024 saw Google open a major AI hub in Saudi Arabia, aligning with the Saudi Vision 2030 initiative and projected to drive local economic growth through AI-driven solutions (en.wikipedia.org).

This indicates Google is balancing workforce streamlining with international AI investment.

What to Watch: Potential Next Moves

- Further Buyouts or Layoff Waves?

Earlier rounds in 2023–2024 targeted Platforms & Devices, HR, Legal, and Finance; these new offers may foreshadow more across other divisions (ainvest.com). - Office Return Impact

Watch employee sentiment and retention as hybrid mandates kick in by September, with possible splits in satisfaction, productivity, and culture. - AI Product Momentum

Will Gemini, AI-overview, and future generative tools accelerate as the team becomes more tightly aligned? - Regulatory Tides

Ongoing antitrust lawsuits may drive Google to continue shedding units or avoid further redundancies—regulatory eyes are watching both workforce strategy and acquisition behavior.

External Resources & Further Reading

- The Verge: Google’s Search, Marketing, Research, and Core Engineering employees in the U.S. are offered buyouts.

- Business Insider: Google intensifies RTO mandate and expands voluntary exit offers (businessinsider.com).

- The Wall Street Journal: Link between increased AI capital spending and the buyout program (wsj.com).

- TheInformation: Deep dive into buyouts, workforce alignment, and future direction (theinformation.com).

For full corporate context, read about Google’s largest acquisition of Wiz here: Google to buy cybersecurity firm Wiz for $32 billion – AP News (apnews.com).

Final Take: A Strategic Gamble on AI and Co‑Location

By combining “google buyouts” with stricter hybrid mandates, Google is aggressively reshaping its internal ecosystem to support a future centered on AI innovation and on‑site collaboration. This voluntary program gives workers a dignified exit, but clearly delineates a new era—one where Google expects a team deeply motivated and physically present to fuel the next wave of AI breakthroughs.

For those staying, the challenge will be to align closely with AI goals, reinvigorate innovation, and rebuild a collaborative culture inside offices. For those exiting, this is a major career adjustment with both opportunity and uncertainty.

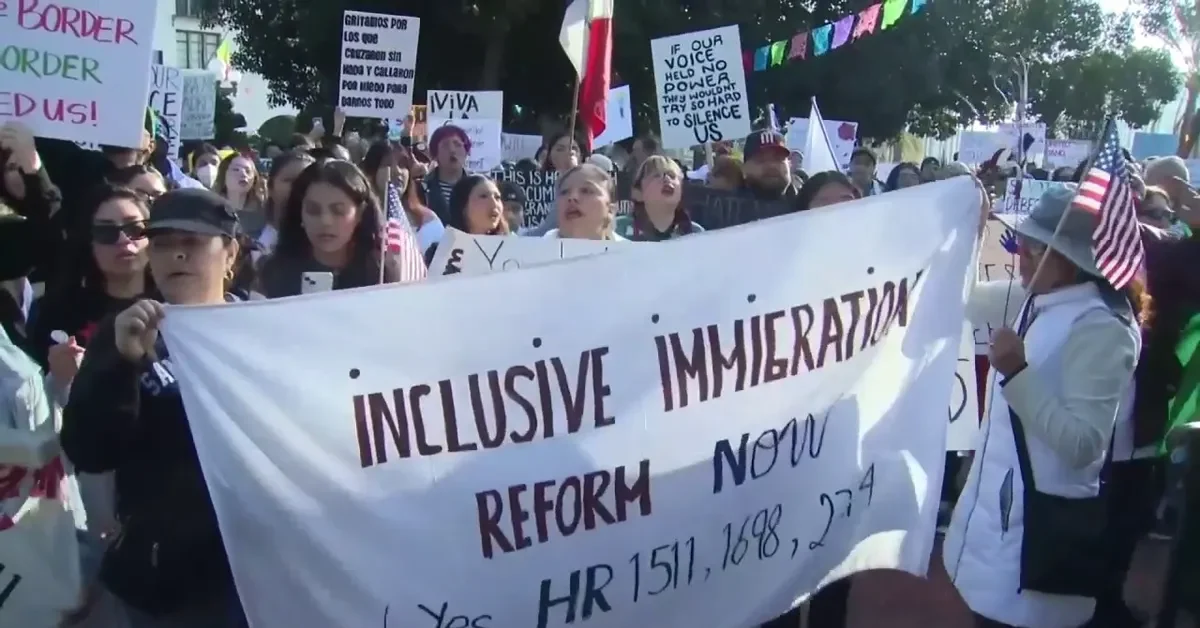

Protesters clash with law enforcement outside the Metropolitan Detention Center as Waymo vehicles burn. (Credit: Jae C. Hong/AP )

Protesters clash with law enforcement outside the Metropolitan Detention Center as Waymo vehicles burn. (Credit: Jae C. Hong/AP )